Financial services, perhaps one of the most competitive industries out there.

Accounting, investment and wealth management, consulting, and tax services. Extremely complex jobs that require a lot of trust and even loyalty. Bringing in new customers is not easy, but thanks to technology, you now have new tools to maximize lead generation and conversion.

Since financial professionals still do a lot of work over the phone, call tracking can provide valuable insights into the marketing campaigns, channels, and customer behaviors that drive sales.

In this article, we will talk about how call tracking in financial services can give you a competitive edge, improve your relationships with customers, and drive growth for your business.

Diving deep into call tracking: What is it & how it can help you

In a nutshell, call tracking is a tool that enables its users to monitor and analyze incoming phone calls. You generate unique phone numbers that you place in your marketing campaigns, websites, landing pages, emails, etc and when someone calls one of these tracking numbers, the call is rerouted to your normal business number.

At the same time, the call tracking tool captures crucial call data and also records and transcribes the call, something very important in financial services, where personalized communication plays a vital role in building trust with clients.

This data includes information about where their calls are coming from, whether it’s an online ad, a social media post, or a website visit. You can then use this data to optimize your marketing efforts and identify which channels generate the most qualified leads. It also tracks offline efforts like direct mail or print advertising, ensuring all customer touchpoints are accounted for, regardless of the source.

Call Tracking in a Nutshell

Call tracking refers to the technology that enables the monitoring and recording of inbound phone calls. It’s essentially a system that uncovers how callers discovered your business. By assigning unique phone numbers to different marketing channels, Marketers can pinpoint which ads, campaigns, or search keywords are generating calls. This data is critical because it shows you what’s working in your marketing strategy and what’s not.

💡Check out the complete Call Tracking Guide!

Sounds good, but how does it help with sales?

The main advantage of call tracking in financial services is connecting offline interactions like phone calls with online marketing campaigns. In this industry, customers typically begin their journey with online research, but they eventually reach a stage where they want to speak with a real person—a representative who can explain what they offer and why they should work with them.

While online marketing is easy to track and measure, phone calls are not. Call tracking bridges the data gap between those two stages, providing sales reps with a clear understanding of the customer journey.

Call tracking in financial services identifies the specific source of each call, such as which campaign or keyword led to that interaction. This way, sales teams can:

- Focus on leads most likely to convert into clients.

- Distribute marketing resources to the most effective channels.

- Personalize customer conversations by knowing their journey before they even pick up the phone.

With these insights, closing deals and converting leads becomes much easier.

Main call tracking features

Now, let’s talk about the most important call tracking features.

Call attribution

The most valuable one. Call attribution. Knowing the source of the call and which marketing channel, keyword, ad, or campaign, helped make it real. For example, if a potential client calls after seeing an online ad, call tracking can identify which ad and keyword led to the interaction. This level of attribution enables businesses to:

- Pinpoint the most effective marketing campaigns.

- Adjust marketing strategies to focus on high-performing channels.

- Allocate marketing budgets more effectively by prioritizing efforts that deliver the best results.

Precision and personalization are basic expectations that customers have from financial services businesses. So, you can see why understanding what drives phone calls is essential. By attributing calls to specific campaigns, call tracking in financial services ensures no opportunity for improvement is missed.

Call analytics

Knowing the source is only the beginning. Call tracking in financial services also offers powerful analytics. Call analytics tools capture critical data such as call duration, frequency, and outcome, that can help you measure the effectiveness of your sales and marketing efforts.

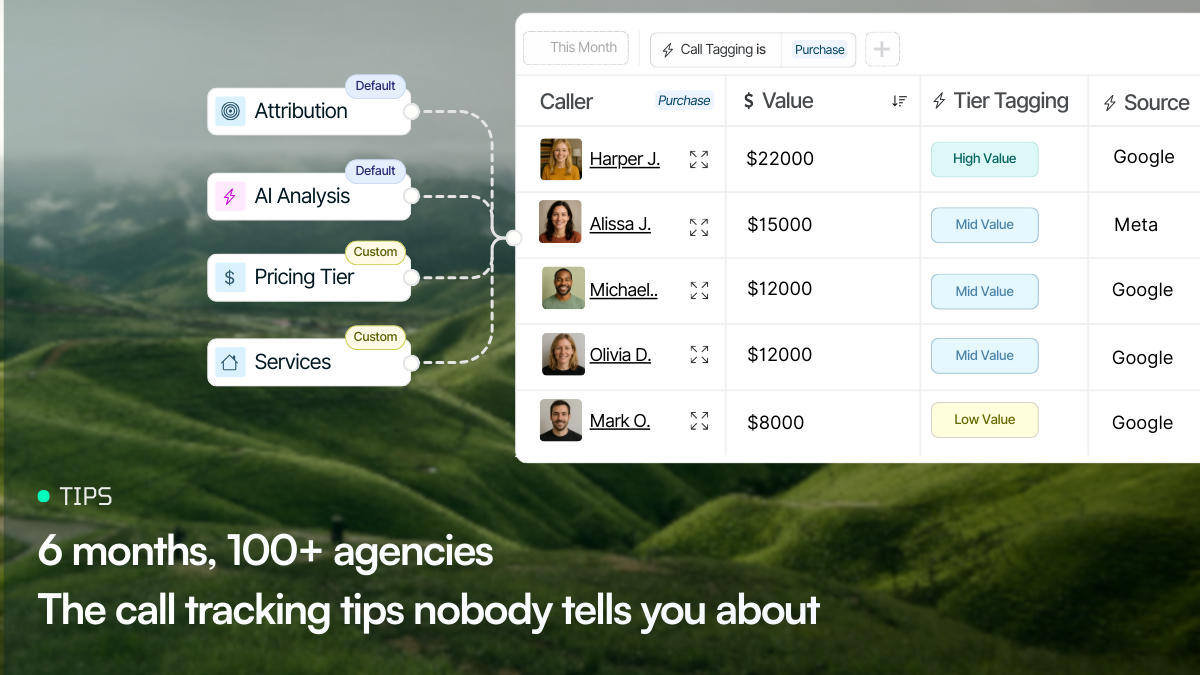

AI touches everything and it touched call tracking too. Tools like Nimbata, include AI features like word and phrase spotting, call summaries, and extensive automations that can analyze conversations to detect customer sentiment, identify frequently asked questions, and even predict the likelihood of a conversion. With this information, sales teams can:

- Improve call handling techniques.

- Address common customer concerns more effectively.

- Refine sales pitches to align with customer needs.

Lead qualification & scoring

The endgame of the whole lead generation and conversion process. Separating the good from the bad leads, focusing on the first and converting them into paying customers.

Call tracking helps here too. Call tracking systems can assess the quality of leads by analyzing call length, customer inquiries, and engagement levels. You can easily build automations that combine filters and criteria of your choice and actions that the call tracking tool will take accordingly.

For example, you can set the tool to tag calls that last over 5 minutes and include keywords such as “accounting services” and others as “high-quality leads”. This way, your sales team can:

- Prioritize high-quality leads for follow-up.

- Tailor sales approaches based on the customer’s stage in the buying journey.

- Increase efficiency by focusing efforts on leads most likely to convert.

This approach will enable you to quickly qualify leads and focus your efforts on the more valuable ones, instead of wasting time and resources on low chance of converting leads.

Sales through call tracking: The key to growth

Marketing Optimization

To optimize your marketing campaigns, you need to know where there is room for improvement and what’s going wrong. To do that, you need data.

Call tracking in financial services provides detailed insights into which campaigns, ads, or channels are driving the most calls and working as they were intended to. So, instead of relying on guesswork, you can focus on the strategies that produce the highest-quality leads and conversions.

For instance, if call tracking reveals that a particular paid search campaign is generating more inquiries about mortgage loans or wealth management services, the company can allocate more budget to that campaign. This optimization leads to more efficient use of resources and helps ensure marketing efforts are targeted toward the channels with the best performance.

Focus on the high-quality leads

Most leads are unfortunately worthless or need quite some nurturing before they are ready to make a decision.

Call tracking in financial services will help you identify and prioritize the high-value leads that can convert faster and easier. By analyzing call data, including the duration of calls, the topics discussed, and the level of customer engagement, financial institutions can score leads based on their likelihood to convert.

For example, a lead who calls to discuss detailed investment strategies or mortgage options is more likely to convert than someone asking about general account information. Sales teams can use this information to focus their efforts on leads that show higher intent, reducing time spent on lower-quality leads and increasing conversion rates.

Improved customer experience

Customer experience is what makes the real difference in the financial services industry. Customers expect top-level and personalized service. Call tracking in financial services will not only help you understand the origin of your leads but also improve the overall customer experience by making interactions more personalized.

Call tracking tools store and retrieve data from previous calls, so you can pick up conversations where you left them off. This saves the trouble and frustration of asking customers to repeat questions they already have.

Building a personalized service will enhance the overall customer experience and foster long-term relationships.

Performance monitoring for sales teams

Call tracking in financial services offers another very valuable tool. You can monitor and assess the performance of your sales teams. By analyzing metrics, such as the number of calls handled, conversion rates, and overall call quality, you can identify areas for improvement and provide targeted training to team members.

Plus, you can review call recordings to ensure compliance with the strict regularity standards that permeate most legal systems.

Better performing sales teams mean increased customer satisfaction which leads to more conversions.

Call tracking in financial services: Guide & tips

We will show you now how to use call tracking for your financial services business.

Step 1: Define sales & marketing goals

First of all, before you rush off to pick your call tracking tool, you must establish clear goals for your sales and marketing teams. Understand what you want to achieve with call tracking, increased lead generation, improved customer retention, and better customer experience, so you can shape and configure the tool to your needs.

For example, financial firms might prioritize tracking calls that result from high-value products like mortgages or investment accounts. By defining specific goals, you can ensure that call tracking aligns with the overall objectives of your business.

Key questions to consider:

- What are the key performance indicators (KPIs) for marketing and sales?

- Which products or services drive the most revenue, and should these be a priority?

- How can call tracking enhance lead generation, lead scoring, or customer retention efforts?

Step 2: Choose the call tracking tool that fits your goals

You have your goals and you know what you want your call tracking tool to do for you.

Selecting the appropriate one is critical. Not every call tracking platform is the same, and financial services should choose the one that offers features that meet their specific needs.

For example, a solution that includes dynamic number insertion (DNI), multi–channel attribution, and keyword-level tracking will allow for precise tracking of marketing efforts. Additionally, financial firms may benefit from advanced analytics tools, such as AI-driven speech analytics, which can provide deeper insights into customer behavior and call outcomes.

When selecting a call tracking platform, consider:

- Integration with your existing customer relationship management (CRM) and marketing tools.

- The ability to comply with financial regulations (e.g., GDPR, TCPA).

- Whether the solution offers secure data storage and encryption to protect sensitive customer information.

Step 3: Train your team

After setting up your call tracking system, it’s important to train your sales and marketing teams to make the most out of it. No matter how much data you generate from it, it will be useless if your teams don’t know how to interpret them and apply them to their strategies.

Training should cover how to access call reports, use call analytics for performance improvement, and understand attribution data to optimize marketing campaigns.

Key training areas include:

- How to identify high-value leads using call data.

- Interpreting call attribution reports to improve marketing efforts.

- Using call analytics to enhance sales conversations and customer interactions.

Step 4: Ensure compliance

Regulations in the financial services industry are usually strict and complex. The use of any customer data must comply with relevant laws. Ensuring that your call tracking in financial services solution meets these requirements is essential to avoid legal issues. Be sure that your platform offers features like consent management, secure data storage, and encryption.

Important regulations to consider:

- General Data Protection Regulation (GDPR): If you operate in the European Union, you must comply with GDPR regarding the storage and use of personal data.

- Telephone Consumer Protection Act (TCPA): In the United States, the TCPA regulates telemarketing calls and the use of recorded messages.

- Financial Industry Regulatory Authority (FINRA): For financial institutions, FINRA requires that all communications, including phone calls, are recorded and stored securely to ensure compliance with industry standards.

Step 5: Monitor & optimize

The process doesn’t end when you start using call tracking. Continuous monitoring and analysis of the data are essential to refining your strategies and improving outcomes. Regularly reviewing call reports and analytics will help you identify trends, measure the effectiveness of marketing campaigns, and evaluate sales performance.

Actions to take:

- Review call attribution data to determine which campaigns are driving the most calls and conversions.

- Analyze customer conversations to uncover common questions, concerns, and opportunities for personalized interactions.

- Adjust marketing and sales strategies based on data-driven insights, ensuring that resources are focused on high-performing areas.

Takeaway

Call tracking in financial services can be a real game changer for your business.

By providing valuable data and insights into marketing performance, lead attribution, and customer interactions, call tracking can help you make data-driven decisions that boost lead generation, optimize resources, and personalize the customer experience. With the right implementation and ongoing analysis, call tracking can become a vital tool for driving sustainable growth and maintaining a competitive edge in the industry.